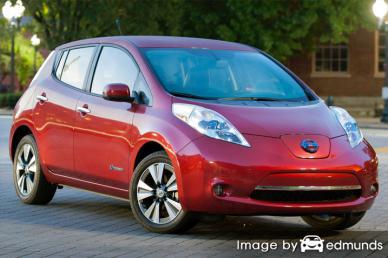

Are you regretting buying high-priced Nissan Leaf insurance in Philadelphia? Don’t feel bad because there are many people just like you.

Are you regretting buying high-priced Nissan Leaf insurance in Philadelphia? Don’t feel bad because there are many people just like you.

Smart shoppers know that insurance companies don’t want policyholders to compare prices from other companies. Drivers who shop around are very likely to switch companies because they stand a good chance of finding more affordable rates. Remarkably, a study showed that consumers who compared rates annually saved over $72 a month compared to drivers who don’t make a habit of comparing rates.

If saving the most money on Nissan Leaf insurance in Philadelphia is the reason you’re here, then having some insight into the best way to shop and compare insurance rates can save money and time. Due to the large number of companies and agents to choose from, it’s difficult to pick a more affordable insurance provider.

Buying the cheapest auto insurance in Philadelphia is not rocket science. If you have a policy now or are just looking to switch companies, use these cost-cutting techniques to find the best rates without reducing coverage. Drivers just need to use the most efficient way to buy auto insurance online from multiple companies.

Many insurance companies make it easy to get insurance quotes on their websites. Getting online rates for Nissan Leaf insurance in Philadelphia is fairly simple as you just type in your required coverages into a form. Once you submit the form, the quote system sends out for your driving and credit reports and generates a price based on these and other factors. Getting online rates for Nissan Leaf insurance in Philadelphia simplifies rate comparisons, and it’s absolutely necessary to have as many quotes as possible if you want to get affordable auto insurance pricing.

In order to compare rates now, compare quotes from the companies shown below. To compare your current rates, we recommend you type in the insurance coverages identical to your current policy. Doing this assures you will have comparison quotes for the exact same coverage.

The companies shown below are ready to provide free quotes in Pennsylvania. If multiple companies are listed, we suggest you visit two to three different companies to get the best price comparison.

Why you need insurance for your Leaf

Despite the potentially high cost of Nissan Leaf insurance, paying for car insurance may not be optional for several reasons.

First, most states have minimum mandated liability insurance limits which means it is punishable by state law to not carry specific minimum amounts of liability coverage in order to drive the car legally. In Pennsylvania these limits are 15/30/5 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $5,000 of property damage coverage.

Second, if you have a lien on your vehicle, it’s guaranteed your bank will require that you have physical damage coverage to ensure they get paid if you total the vehicle. If you cancel or allow the policy to lapse, the lender may insure your Nissan at a significantly higher premium and make you pay for it.

Third, insurance safeguards both your car and your assets. It will also provide coverage for many types of medical costs for not only you but also any passengers injured in an accident. One policy coverage, liability insurance, also covers legal expenses if you are sued as the result of your driving. If mother nature or an accident damages your car, collision and comprehensive coverages will cover the damage repairs after a deductible is paid.

The benefits of carrying enough insurance are without a doubt worth the cost, particularly for liability claims. An average driver in America is overpaying over $855 a year so you should quote rates at every renewal to ensure rates are competitive.

Learn How to Lower Your Insurance Premiums

Smart consumers have a good feel for some of the elements that aid in calculating the rates you pay for insurance. When you understand what impacts premium levels, this allows you to make good choices that may reward you with lower insurance prices.

The factors shown below are some of the most rate-impacting factors used by insurance companies to determine prices.

Discounts for married couples – Getting married can actually save you money on your insurance bill. Having a spouse translates into being more financially stable and insurance companies like that being married results in fewer claims.

Your credit score is important – Your credit rating will be a significant factor in determining your rates. Consumers who have good credit tend to be less risk to insure than drivers who have poor credit scores. Therefore, if your credit rating is low, you could pay less to insure your Nissan Leaf if you improve your credit rating.

Always have insurance – Not maintaining insurance is a misdemeanor and any future policy may cost more because you let your coverage lapse. In addition to paying higher rates, failure to provide proof of insurance may earn you a hefty fine and possibly a revoked license. You could then be forced to provide proof of insurance in the form of an SR-22 filing with the Pennsylvania DMV.

Cautious drivers have lower rates – Careful drivers pay lower auto insurance prices compared to drivers with tickets. Having a single citation can bump up the cost substantially. Drivers who have received serious tickets like DUI or willful reckless driving are required to file a proof of financial responsibility form (SR-22) with their state in order to legally drive.

Keep the miles off and save – The more miles you rack up on your Nissan annually the more you’ll pay to insure it. Most insurance companies apply a rate determined by how the vehicle is used. Vehicles that are left in the garage receive better premium rates than vehicles that are driven to work every day. It’s a good idea to make sure your insurance declarations sheet reflects the proper vehicle usage. A policy that improperly rates your Leaf may be wasting your money.

Insurance loss statistics a Nissan Leaf – Insurance companies include the past claim trends for vehicles to help set a rate to offset losses. Models that the statistics show to have higher loss trends will cost more for coverage.

The table below illustrates the historical insurance loss data for Nissan Leaf vehicles. For each insurance policy coverage type, the statistical loss for all vehicles averaged together is set at 100. Numbers that are below 100 suggest a better than average loss history, while percentages above 100 show a trend for more claims or an increased likelihood of larger losses.

| Vehicle Make and Model | Collision | Property Damage | Comp | Personal Injury | Medical Payment | Bodily Injury |

|---|---|---|---|---|---|---|

| Nissan Leaf Electric | 89 | 84 | 45 | 83 | 64 | 76 |

Statistics from IIHS.org for 2013-2015 Model Years

Verify you’re applying every discount

Car insurance is not cheap, but there may be some discounts that you may not even be aware of. Certain discounts will be triggered automatically at the time of quoting, but occasionally some discounts must be specifically requested before they will apply. If you don’t get every credit possible, it’s possible you qualify for a lower rate.

- Low Mileage – Fewer annual miles on your Nissan may enable drivers to earn lower rates on the low mileage vehicles.

- Savings for New Vehicles – Adding a new car to your policy can get you a discount due to better safety requirements for newer vehicles.

- Sign Early and Save – A few insurance companies give discounts for renewing your policy before your current Leaf insurance policy expires. You can save around 10% with this discount.

- Accident Forgiveness Coverage – This one isn’t a discount, but some insurance companies will turn a blind eye to one accident without getting socked with a rate hike if you are claim-free for a certain period of time.

- Policy Bundle Discount – If you can combine your auto and homeowners policy with the same company you may earn over 10 percent off each policy depending on the company.

- Anti-lock Brakes – Cars and trucks that have steering control and anti-lock brakes are much safer to drive and will save you 10% or more on Leaf insurance in Philadelphia.

- Payment Discounts – If you pay your bill all at once rather than paying in monthly installments you could save 5% or more.

- E-sign Discounts – A handful of insurance companies will discount your bill up to fifty bucks just for signing your application on your computer.

- Multi-Vehicle Discounts – Buying a policy with multiple cars with the same auto insurance company can get a discount for every vehicle.

Discounts reduce rates, but you should keep in mind that some of the credits will not apply to the whole policy. A few only apply to specific coverage prices like medical payments or collision. Even though it may seem like all the discounts add up to a free policy, auto insurance companies aren’t that generous.

Companies and some of the premium reductions they offer can be read below.

- GEICO has discounts for air bags, membership and employees, emergency military deployment, anti-theft, federal employee, multi-policy, and good student.

- Travelers may include discounts for driver training, early quote, IntelliDrive, home ownership, hybrid/electric vehicle, and continuous insurance.

- Farm Bureau offers discounts including multi-vehicle, good student, youthful driver, safe driver, multi-policy, driver training, and 55 and retired.

- Liberty Mutual offers premium reductions for multi-policy, newly married, preferred payment discount, newly retired, and multi-car.

- American Family discounts include early bird, mySafetyValet, Steer into Savings, air bags, and accident-free.

- Progressive policyholders can earn discounts including multi-vehicle, multi-policy, online quote discount, good student, and continuous coverage.

Check with every prospective company how you can save money. Some discounts listed above might not be offered on policies in your state.

Buying auto insurance from Philadelphia insurance agents

Some people still like to sit down and talk to an agent and that is not a bad decision Professional insurance agents are trained risk managers and help in the event of a claim. One of the benefits of getting free rate quotes online is the fact that drivers can get cheap rate quotes and also buy local.

To find an agent, once you fill out this quick form, the coverage information is submitted to participating agents in Philadelphia that give free quotes for your coverage. You don’t have to visit any agencies as quotes are delivered to you instantly. If you need to get a price quote from a specific company, just visit that company’s website and give them your coverage information.

Selecting an insurer should depend on more than just a low price. Below are some questions you should ask.

- Are they in the agency full-time?

- What is their Better Business Bureau rating?

- Do they offer rental car reimbursement?

- Will you be dealing directly with the agent or with a Custom Service Representative (CSR)?

- Did they already check your driving record and credit reports?

- What will you get paid if your car is a total loss? How is that amount determined?

- Do the coverages you’re quoting properly cover your vehicle?

When finding a reliable agent, it’s helpful to know the different agency structures and how they differ in how they can insure your vehicles. Agents in Philadelphia are considered either exclusive or independent agents depending on their company appointments. Both types can sell auto insurance policies, but it’s important to point out the difference in how they write coverage since it could factor into your agent selection.

Exclusive Auto Insurance Agents

Agents that elect to be exclusive have only one company to place business with and examples are Farmers Insurance or State Farm. These agents are not able to provide other company’s prices so they have no alternatives for high prices. Exclusive agencies are usually well trained on what they offer which helps offset the inability to provide other markets.

Listed below is a list of exclusive agencies in Philadelphia that are able to give comparison quotes.

Alden Thomas – State Farm Insurance Agent

7983 Oxford Ave – Philadelphia, PA 19111 – (215) 745-3700 – View Map

Erica Bantom Martin – State Farm Insurance Agent

1124 S Broad St – Philadelphia, PA 19146 – (215) 875-8100 – View Map

John Nicolucci – State Farm Insurance Agent

6001 Ridge Ave – Philadelphia, PA 19128 – (215) 482-7000 – View Map

Independent Auto Insurance Agents

These agents do not write with just one company and that gives them the ability to insure with a variety of different insurance companies depending on which coverage is best. If you are not satisfied with one company, your agent can just switch to a different company and you don’t have to find a new agent. When shopping rates, you should always check rates from a few independent agents to get the most accurate price comparison.

Below are Philadelphia independent insurance agents willing to provide price quote information.

Pa Auto Insurance Outlet

4901 Frankford Ave – Philadelphia, PA 19124 – (215) 827-0800 – View Map

McCollum Insurance Agency

4169 Main St – Philadelphia, PA 19127 – (215) 508-9000 – View Map

Larry Lewis Insurance Agency, LLC

4548 Market St #208 – Philadelphia, PA 19139 – (215) 243-4110 – View Map

If you receive reasonable responses as well as an affordable premium quote, you’ve probably found an auto insurance agent that meets your needs to insure your vehicles. Just remember you can cancel a policy whenever you wish so never feel you’re contractually obligated to a policy with no way to switch.

You can find cheaper coverage

As you quote Philadelphia auto insurance, it’s very important that you do not sacrifice coverage to reduce premiums. There are too many instances where someone sacrificed comprehensive coverage or liability limits and found out when filing a claim that it was a big error on their part. The proper strategy is to purchase plenty of coverage at the best cost, not the least amount of coverage.

Discount Nissan Leaf insurance in Philadelphia is attainable from both online companies in addition to many Philadelphia insurance agents, so you need to shop Philadelphia auto insurance with both so you have a total pricing picture. There are still a few companies who don’t offer the ability to get quotes online and many times these smaller providers only sell coverage through independent agents.

For more information, take a look at the resources below:

- Vehicle Insurance (Wikipedia)

- Who Has the Cheapest Philadelphia Car Insurance for Electric Cars? (FAQ)

- Who Has Cheap Auto Insurance for a Chevrolet Equinox in Philadelphia? (FAQ)

- State Car Insurance Guides (GEICO)

- When is the Right Time to Switch Car Insurance Companies? (Allstate)

- Auto Insurance Basics (Insurance Information Institute)